Ii Taxable person means any person who is or is liable to be registered under section 2 GSTA. Goods and Services that fall under each category predetermined by the Royal Custom Department of.

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate Malaysia

If any residential property is.

. It is located gst on commercial property sale of. The DG came out with a further decision on Oct 28 2015 stating that owning more than 2 commercial properties or owning more than 1 acre of commercial land worth more than RM2 million would be subject to GST if the individual has an intention to sell the commercial properties subject of course to the taxable supply exceeding the threshold of RM50000000. Whether an individual has to charge GST when making a supply of his commercial property.

Non-compliance to Malaysian Accounting Standard Board. The current regulations might confused a lot of people who originally thought they were exempt from this levy according to Deloitte Malaysia an accountancy firm. Just in case someone missed out below are the latest update on Individual Supplying Commercial Property Rent Sell DECISION BY DIRECTOR GENERAL OF ROYAL MALAYSIAN CUSTOMS.

12018 issued by the Malaysian Tax Agency sets forth the applicability of the goods and services tax on the sale of buildings located on commercial land used for both commercial and residential purposes. Individual supply commercial property. A person is liable to be.

Whether an individual has to charge GST when making a supply of his commercial property. In Singapore Malaysia has a public-called Goods and Services Tax GST. You need to pay GST in case you fall under any of the below descriptions.

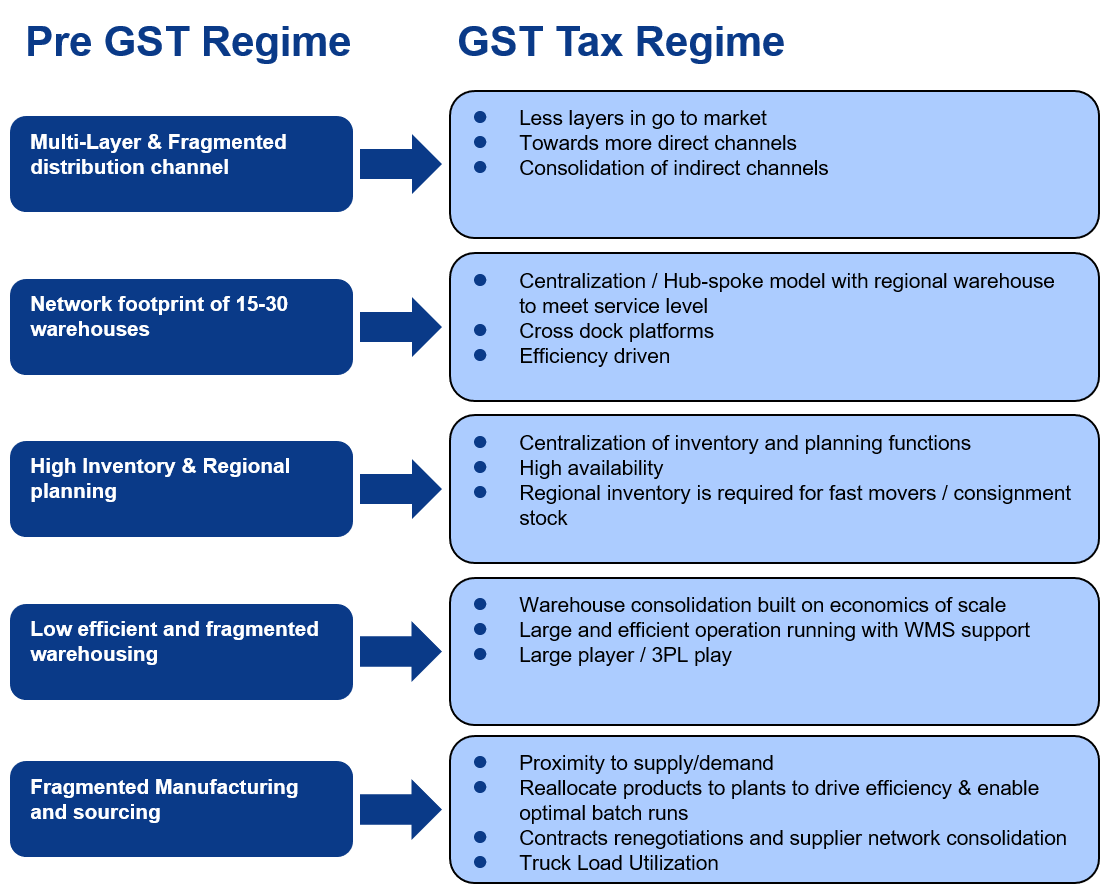

I GST shall be charged by a taxable person in the course or furtherance of business on any taxable supply of goods or services made in Malaysia section 9 GSTA. Individual supply commercial property i on any taxable supply of goods or services made in Malaysia section 9 GSTA. Item 1Small Office Home Office SOHO Item 2Supply of commercial property build sell by the developer to the purchaser under an agreement for a period that begins before the effective date and ends on or after the.

Our lawyers in Malaysia describe the provisions of the Public Ruling and can help. New guidelines were issued recently by the Royal Malaysian Customs Department that includes more people being required to pay the Goods Services Tax GST when selling a commercial property The Star reported. Sales of commercial real estate such as office towers retail buildings and.

GST had been exempted on renting of residential property to any person up to 17 th July 2022 but according to the recent amendment under GST Act GST is applicable on Residential Property with effect from 18 th July 2022 Renting an immovable property is considered as a supply of service and it attracts GST 18. Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent GST if the seller is an individual is engaged in the business. Item 3Eligibility for deemed Input Tax under Regulation 47 of the GST Regulations 2014 PU A 1902014.

After talks of implementation for 26 years GST in Malaysia was. Malaysian GST for commercial properties and individuals explained. GSTA section 2 of the current month and the next eleven months exceeds RM500000 GST shall be charged by a taxable person in the course or furtherance of business.

You have more than two commercial properties. The same as for commercial property in Singapore Malaysia has a so-called Goods and Services Tax GST. 22022016 commercial property more than rm2 million have to registered for gst in malaysia.

They are standard rated supplies zero rated supplies exempt supplies and supplies not within the scope of GST. 2 GST FOR space PROPERTY for title on Goods and efficient Tax GST was implemented on April 1 2015 at a fixed rate of 6 Malaysian. This dgs decision clarifies the gst treatments for individual supplies commercial properties ie.

Whether an individual has to charge GST when making a supply of his commercial property. Goods Services Tax GST Under the scope of Goods and Services Tax GST in Malaysia supplies fall into 4 categories. GST on the Sale of Property for Commercial and Residential use.

In light of the Director Generals clarification it would appear that an individual who makes a supply of two or less commercial property or a commercial land not larger than 1 acre within a 12 months period would not be treated as carrying out business even if such sale exceeds RM500000 provided that the market of the commercial property or land is below. Malaysia GST Types of Supply.

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Valued Insights Asia Pacific Logistics Cbre

Update On Gst And Commercial Property In Malaysia Taxation News

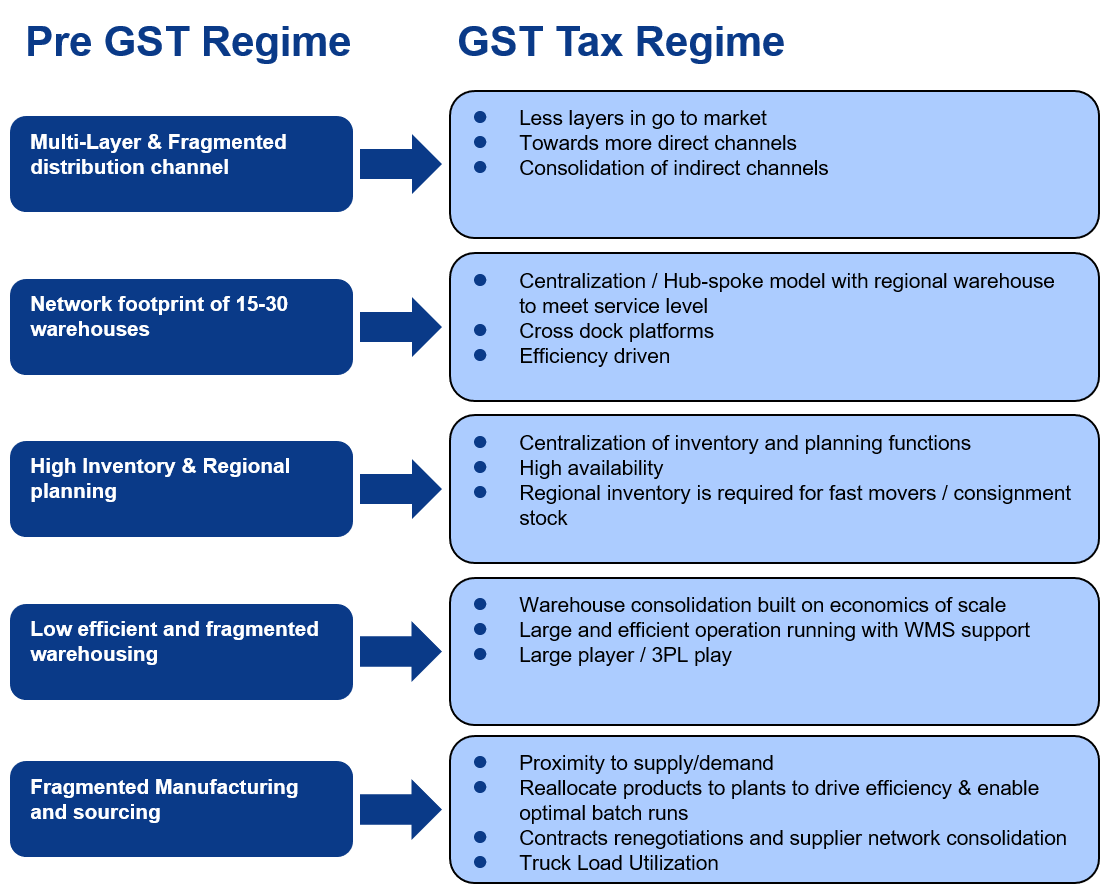

India S Tax Reform Its Impact To Supply Chain

Taxation And Gst Planning For Investment Property In Malaysia

Malaysia Sst Sales And Service Tax A Complete Guide

Lawyer S Billings How Much Gst Hst To Charge Thang Tax Law

Buying Commercial Property In Malaysia A Complete Guide

The Connection Issue 21 Individual Supply Of Commercial Property Land Cheng Co Group

New Strategies Inspire Big Growth For Manufacturers With Smaller Footprints

Sst Will Property Prices Come Down Edgeprop My

The Connection Issue 21 Individual Supply Of Commercial Property Land Cheng Co Group

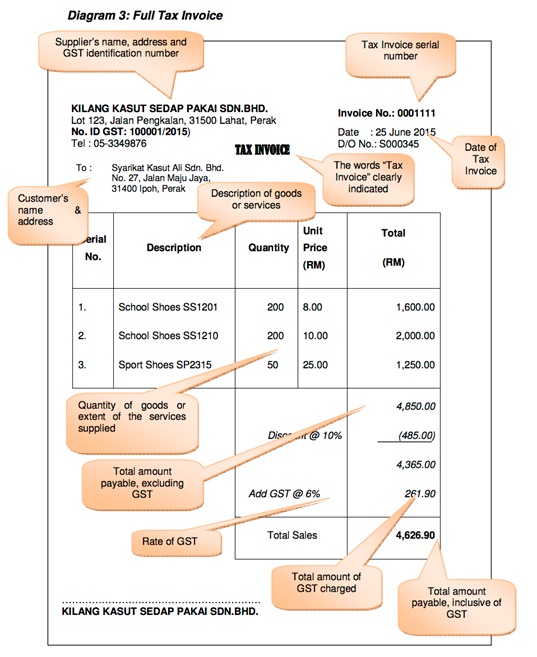

Holding Company And Input Tax Credits In Relation To A Subsidiary Sales Taxes Vat Gst Canada

Update On Gst And Commercial Property In Malaysia Taxation News

The Connection Issue 21 Individual Supply Of Commercial Property Land Cheng Co Group

Real Estate New Gst Rates And Challenges